Acheson corporation which applies manufacturing overhead – Acheson Corporation, a global leader in the manufacturing industry, has implemented a comprehensive system for applying manufacturing overhead, enabling accurate product costing, efficient cost control, and enhanced profitability. This in-depth analysis explores Acheson Corporation’s innovative approaches to overhead allocation, examining the types of overhead costs incurred, allocation methods employed, and strategies for controlling these expenses.

By delving into the case study of Acheson Corporation, we uncover valuable insights into industry best practices, enabling organizations to optimize their manufacturing overhead management and achieve operational excellence.

Manufacturing Overhead Application: Acheson Corporation Which Applies Manufacturing Overhead

Manufacturing overhead refers to the indirect costs incurred in a production process that cannot be directly attributed to specific units of production. These costs include expenses such as rent, utilities, depreciation, and salaries of indirect labor. The application of manufacturing overhead involves allocating these costs to products based on predetermined rates.

Acheson Corporation utilizes two methods to apply manufacturing overhead: the direct labor hours method and the machine hours method. The direct labor hours method allocates overhead based on the number of direct labor hours worked on a product, while the machine hours method allocates overhead based on the number of machine hours used in production.

Types of Manufacturing Overhead, Acheson corporation which applies manufacturing overhead

Acheson Corporation incurs various types of manufacturing overhead costs, including:

- Indirect Labor:Salaries and wages of employees not directly involved in production, such as supervisors, maintenance workers, and quality control inspectors.

- Factory Rent and Utilities:Costs associated with the factory building, including rent, property taxes, insurance, and utilities such as electricity, gas, and water.

- Depreciation:Allocation of the cost of factory equipment and machinery over their useful lives.

- Factory Supplies:Consumable items used in production, such as lubricants, cutting tools, and cleaning supplies.

- Indirect Materials:Materials used in production that cannot be directly traced to specific products, such as adhesives, solvents, and packaging materials.

Overhead Allocation Methods

Acheson Corporation employs several methods to allocate overhead costs to products:

- Direct Labor Hours Method:Allocates overhead based on the number of direct labor hours worked on each product. This method is simple to apply but may not accurately reflect the actual consumption of overhead resources.

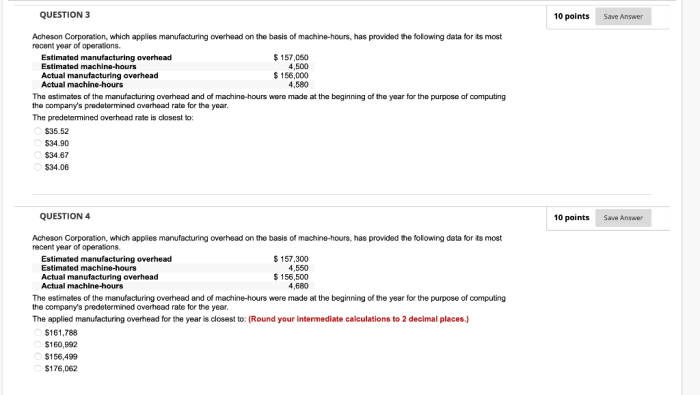

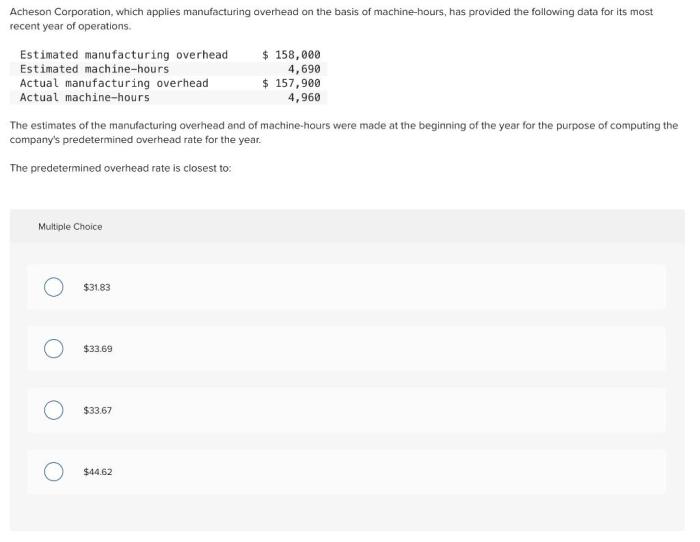

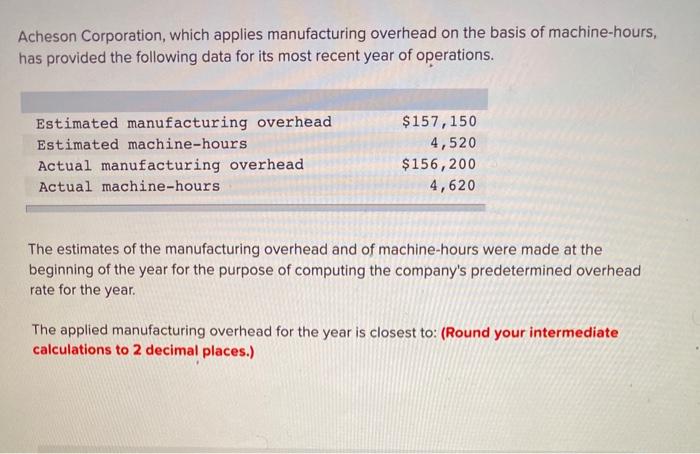

- Machine Hours Method:Allocates overhead based on the number of machine hours used in the production of each product. This method is more accurate than the direct labor hours method but may not be applicable in all production processes.

- Activity-Based Costing (ABC):Allocates overhead based on the activities performed during production. This method is more complex but provides a more accurate allocation of overhead costs.

Impact on Product Costing

The application of manufacturing overhead has a significant impact on the costing of products:

- Product Cost:Overhead costs are included in the total cost of products, affecting their selling price and profitability.

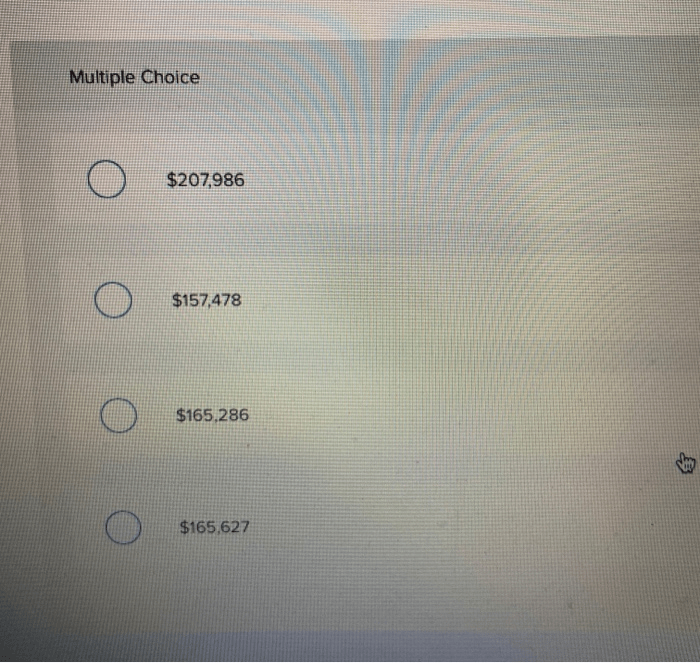

- Overhead Rate:The overhead rate, calculated by dividing total overhead costs by the allocation base, determines the amount of overhead allocated to each product.

- Product Profitability:The application of overhead can affect the profitability of products, as higher overhead rates can reduce profit margins.

Common Queries

What is the significance of manufacturing overhead in product costing?

Manufacturing overhead plays a crucial role in product costing as it represents the indirect costs associated with production, such as factory rent, utilities, and depreciation. Accurate allocation of overhead costs ensures that products bear their fair share of these expenses, leading to reliable product pricing and informed decision-making.

How does Acheson Corporation allocate manufacturing overhead costs?

Acheson Corporation employs a combination of allocation methods, including direct labor hours, machine hours, and activity-based costing. By selecting the most appropriate method for each overhead cost category, the company ensures that costs are assigned to products based on their actual consumption of resources.

What are the key strategies employed by Acheson Corporation for controlling manufacturing overhead costs?

Acheson Corporation has implemented a comprehensive cost control program that includes regular variance analysis, performance benchmarking, and continuous improvement initiatives. By identifying and addressing variances between budgeted and actual overhead costs, the company proactively manages expenses and minimizes waste.